Money laundering operations and terrorist financing activities are close to surpassing the skills and abilities of compliance departments working against them. To stay one step ahead, compliance teams need to address what has recently changed in the world of illicit finance to comprehend what can be done despite it. This means using AML transaction monitoring directions to accurately identify theft and fraud as they occur and report suspicious communications while limiting the number of false positives.

AML units must adapt and alter the way they work when dealing with risk exposure, fines, and status damage. To take this step, AML teams need to offer compliance corporations better brainpower with less work.

Table of Contents

Key TakeawaysAML Transaction Monitoring SystemAML Transaction Monitoring SystemsProgram DataData-Focused ProceduresThe Efficiency Of AML ComputerisationAlert Success RateIncrease Productivity And ValueSummary

Key Takeaways

AML transaction monitoring solutions offer compliance teams help with flagging suspicious transactions and completing reports.AML automated monitoring systems are available for corporations to automate their AML alerts.Automated systems offer data-centric protocols with efficient success rates to increase productivity within and value of companies.

AML Transaction Monitoring System

AML transaction monitoring systems offer advantaged technology with years of human expertise in AML to help detect accurate alerts, lower compliance program costs, and require less work than before. Automated AML programs incorporate the use of AI, machine learning, and robotic process automation (RPA). As a result, the solution gives full coverage for suspicious activity detection, scoring software, real-time alerts, and reports. AML teams can better manage the incoming suspicious activity without requiring more human resources or educational background for employees. Compliance teams can feel confident in their AML protocols, with automated reports that ultimately allow them to make any final conclusions.

AML Transaction Monitoring Systems

With a strong mix of both human expertise and novel technology, the automated program gives compliance teams a unique and incomparable route. Automated AML programs incorporate rules-based models for computerized simulation and give computers the ability to analyze profiles to identify known risky scenarios. When this is paired with newly developed extrapolative analytics, there is the ability to discover new patterns in money laundering that have yet to be identified. The program can learn to identify otherwise hidden relationships between accounts and beneficiaries to meet compliance regulations.

Program Data

The automated threshold and analytics management help quickly and efficiently identify new trends in accounts faster than other methods like human alteration and calculation. When AML regulations change, the models are updated to ensure the system is enhanced to improve overall success rates.

Data-Focused Procedures

The program’s dashboard allows for increased visual insights and provides the data straight to you. These automated processes increase productivity, and teams can rely on the program to predict any inadequacies, allowing them to cut time and costs associated with this administrative work.

The Efficiency Of AML Computerisation

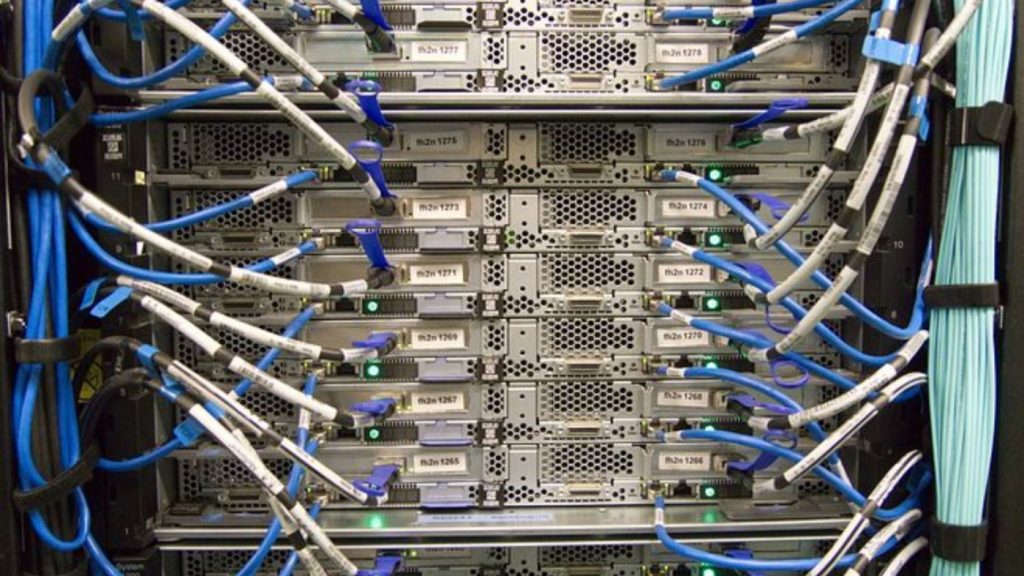

Automation of AI operations using RPA features shortens the time needed to deem an account as suspicious or report this information. This newly freed up time offers another person to work on a separate, more valuable task. The need for redundant computer hardware is also no longer needed, saving money along the way. Compliance teams can function much more efficiently by using new technology to their advantage.

Alert Success Rate

Automated programs can help to lower false positives by up to 30%. With AML transaction monitoring utilizing human expertise and excellent AI software, the protection against laundering schemes is improved, and all daily transactions are looked over at least once.

A multi-phased analytics approach uses rule-based models with automized profiling abilities to identify any possible risk scenarios, find patterns of money laundering threats, identify account relationships, and ensure all regulations are met.Tools are available to tune the machine learning to improve grouping capabilities.Pre-built and tested recognition models with machine learning abilities to detect fast-changing patterns of risky scenarios in the field, including banking, securities, finance, insurance, casinos, gaming, and non-bank institutions.Easy to use access to technology for all teams and managers.Alerts reporting to team members of any high-importance issues.Automated reporting software that meet AML requirements.

Increase Productivity And Value

Automated programs can help you lessen your team’s investigation time. The program allows for a full investigation with case management, improves the productivity of staff members, and helps you lower costs while still meeting regulations.

Quickly understand patterns, learn to gather evidence, and form conclusions based on insights and data storytelling.Information is simply provided to you, giving you the direct input for efficient analysis.Use RPA capabilities that remove the use of an additional data search.Use standard AML protocols, customizable workflows, efficient quality assurance, and case management to create customary procedures that follow AML regulations.Allow investigators to focus only on high-priority alerts.Use automated investigation solutions to collect data from a variety of sources and use auto-populate content to automatically fill out Suspicious Activity Report (SAR), Currency Transaction Report (CTR) forms, and other global financial intelligence unit forms (FIU).

Summary

In summary, new AML directions are taking a step towards automation and computer programs. These novel processes can help lessen time requirements for suspicious activity forms, less the human expertise needed, and monitoring transaction processes on behalf of the company. Businesses should be looking towards adapting to these new techniques to see the benefits they can offer.