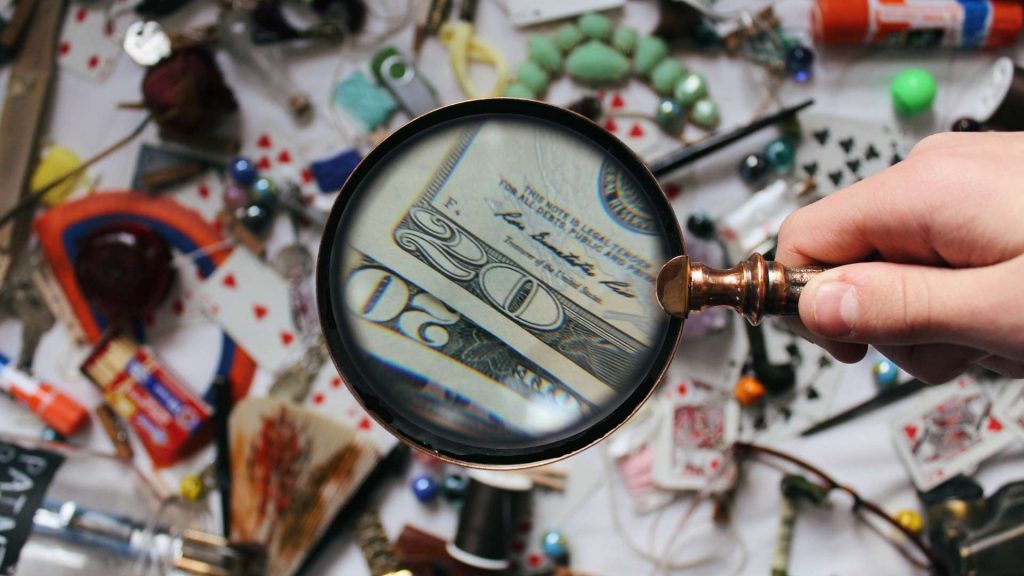

An organization must have a documented Customer Identification Program (CIP) that is appropriate for its size and kind of company to comply with regulatory obligations. The Customer Identification Program must be included in the organization’s anti-money laundering (AML) compliance program, which must be approved by the Board of Directors. This article elaborates on ‘Customer Identification Program: Reliable Measures Against Financial Risks’.

An organization’s clients and consumers must be identified and known. As part of the AML/CTF program, client identification processes, including KYC procedures, must be recorded. The business must establish and implement continuous customer diligence processes to detect, mitigate, and manage money laundering and terrorist financing (ML/TF) threats. This entails creating and documenting EDD software as well as a transaction monitoring procedure.

Reliance on identification and verification already performed

The CDD procedures outlined in FATF Recommendation 5 do not imply that organizations must repeatedly identify and verify each customer’s identification each time they perform a transaction. Unless there are questions regarding the accuracy of the information, an organization has the right to rely on the identification and verification measures it has previously completed.

A suspicion of money laundering or terrorist financing about a particular customer, or a material change in the way the customer’s account is operated that is not consistent with the customer’s initial risk and business profile, are examples of situations that might lead an organization to have such doubts.

Timing of Customer Identification and Verification

Before onboarding clients, it is necessary to complete customer identification and verification. However, depending on changes in the risk profile of clients after onboarding, this may be a continuous process, and it may be necessary to disrupt the initial due diligence.

Customers must be identified in non-face-to-face transactions, securities transactions (for example, in the securities industry, companies and intermediaries may be required to perform transactions very quickly, depending on market conditions at the time the customer contacts them, and the transaction may be required to be completed before verification of identity is completed); and life insurance transactions.

In the case of life insurance, countries may allow the identification and verification of the policy’s beneficiary after establishing a business relationship with the policyholder.

The requirement to identify existing customers

As per FATF, the principles set out in the Basel CDD paper concerning the identification of existing customers should serve as guidance when applying CDD processes to institutions engaged in banking activity and could apply to other financial institutions where relevant.

The general rule is that customers must be subject to the full range of CDD measures, including the requirement to identify the beneficial owner. However, there are situations when the danger of money laundering or terrorist funding is reduced, such as when information about a customer’s name and beneficial owner is publicly known or when proper checks and controls are in place elsewhere in national systems. In such cases, it may be fair for a government to allow organizations to use simpler or reduced CDD methods for identifying and confirming the customer’s and beneficial owner’s identities.

Importance of Customer Identification Program (CIP)

A customer identification program and continuous customer diligence processes will assist in the detection of unusual transactions and behavior, the identification and management of high-risk clients and customers, and the reporting of suspicious matters when they are discovered and investigated. To detect, disrupt, and prevent money laundering and terrorism funding, it’s crucial to know who has ultimate authority over your customer.

It can also safeguard your company or organization from being used for other illegal purposes. All businesses must identify their clients’ beneficial owners and analyze the money laundering and terrorism funding risk they pose. A beneficial owner is a person who owns or controls an entity such as a company, trust, or partnership in the long run.

Owns and Controls

“Owns” in this case means owning 25% or more of the entity. This can be directly (such as through shareholdings) or indirectly (such as through another company’s ownership or a bank or broker).

“Controls,” in this case, means having the power to make decisions about the entity’s finances and operations. They may exert control through trusts, agreements, arrangements, understandings, policies, or practices.

Note that a customer may have more than one beneficial owner. The obligations around the identification and verification of beneficial owners include: determining who your customers’ beneficial owners are, assessing the level of money laundering/terrorism financing risk your customers’ beneficial owners pose to your business or organization, verifying the identity of your customers’ beneficial owners, and keeping records of how you identified each beneficial owner and verified their identity.

Final Thoughts

All organizations are required to have documented CIP appropriate to its size and type to comply with regulatory obligations. This article elaborates on ‘Customer Identification Program: Reliable Measures Against Financial Risks’.