Profiling and understanding fraudsters. Many fraudsters would have been employed by an organization for an extended period of time before engaging in fraudulent activity. This gives the fraudster time to learn how the business works and exploit any vulnerabilities. They can also gain their superiors’ trust and increase their authority within the organization. Furthermore, the seniority of the perpetrator within an organization is highly correlated with the size of the fraud.

Profiling And Understanding Fraudsters: The Fraud Triangle

What is the Fraud Triangle?

The fraud triangle is used to explain why a fraud occurred. But, what exactly is fraud?

Fraud is defined as a deliberate deception perpetrated by an employee or organization for personal gain. In other words, fraud is a deceptive activity used to gain an advantage or illegal profit. Furthermore, the illegal act benefits the perpetrator while harming the other parties involved.

Employees who steal cash from the company’s register, for example, are committing fraud or fraudsters. The employee would benefit from receiving extra money at the expense of the company.

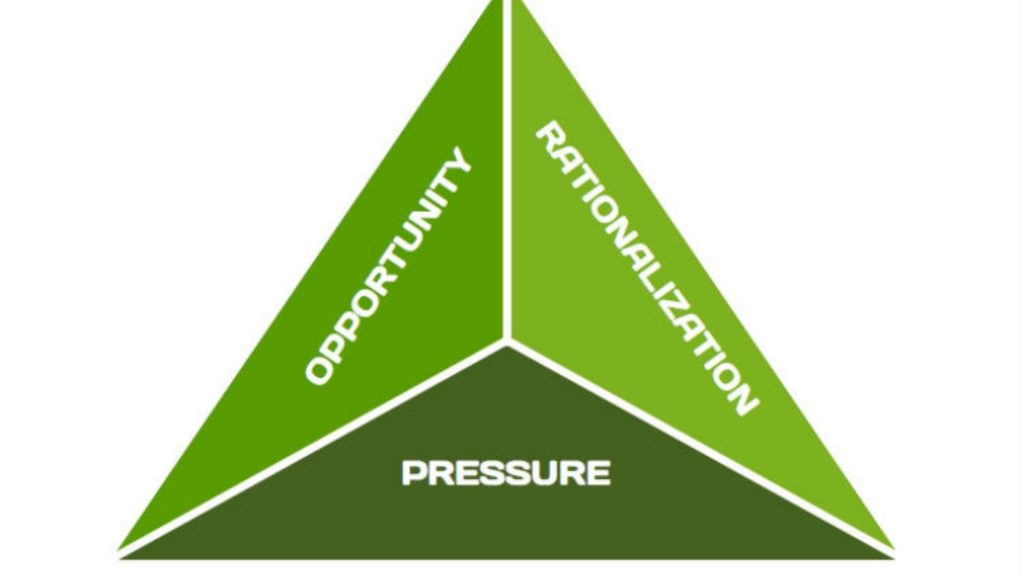

The concept of the Fraud Triangle is generally credited to Donald R. Cressey, who worked in the fields of criminology and white-collar crime. The Fraud Triangle outlines three elements that are present when an individual commits occupational fraud – Pressure, Opportunity, and Rationalization.

Pressure refers to the employee’s motivation, that is, what might drive him to commit fraud. These pressures may not be related to work and are rather personal, such as overwhelming debt, addiction, divorce, or other family issues. However, there may also be work-related pressures.

The opportunity to commit fraud is a risk factor that increases where internal controls are weak or where they do not exist. Companies with strong controls in place help limit employees’ opportunities to engage in fraudulent financial reporting. Companies with limited or no internal controls provide an easy opening for fraud to be perpetrated.

Rationalization is the final factor, and it is how the perpetrator justifies fraud. For instance, a person may feel it is permissible to steal because an injustice was done to him. Rationalization can also occur if an employee sees their superior displaying unethical behavior and getting away with it. In this situation, the employee may feel that management is not concerned with creating an ethical environment and that unethical behavior is tolerated or overlooked.

How can companies prevent and detect fraud?

The Fraud Triangle helps companies understand how and why fraud is committed to taking measures to address the causes of fraud before it occurs.

First, employers can attempt to limit the pressure on employees. It may not be possible to address all pressures on employees, especially if the pressure is from external sources; however, appropriate employment policies may help. In addition, financial and performance goals should be reviewed to ensure they are reasonably attainable and appropriately communicated to employees.

Next, to address the rationalization aspect, it is important for companies to create a corporate culture that values employees, sets proper ethical codes of conduct, and insists on accountability.

Lastly, companies should ensure that internal controls are in place and operating effectively to reduce the opportunity to commit fraud. An operational review conducted by an independent third-party can help companies identify their risks, evaluate their internal controls and make recommendations on where improvements can be made. The review should be comprehensive. These reviews should be done periodically to ensure that changes within the company have not caused internal controls to erode.

Companies should not only implement strong controls; they should also continually engage in fraud detection.

The key takeaway is management, with advice from corporate counsel and accountants, has the power to identify and mitigate fraud risks. While no action can eliminate fraud, implementing policies that address the three arms of the Fraud Triangle will aid in detecting fraud if it does occur.

Final Thoughts

Fraud is a threat in every region and industry. Individuals, families, government institutions, private businesses, and non-profit organizations are among the victims.

Fraud is also becoming more prevalent. Europol considers fraud schemes to be one of Europe’s fastest growing criminal threats. In addition, the number of respondents who had recently experienced fraud in PWC’s 2020 global survey on fraud and financial crime was the second highest in 20 years. According to reports, the total amount lost to fraud scams is increasing.

The first step toward understanding a problem is to recognize it. This article delves into fraud, defining what it is, calculating its cost, and examining the characteristics of a fraudster.