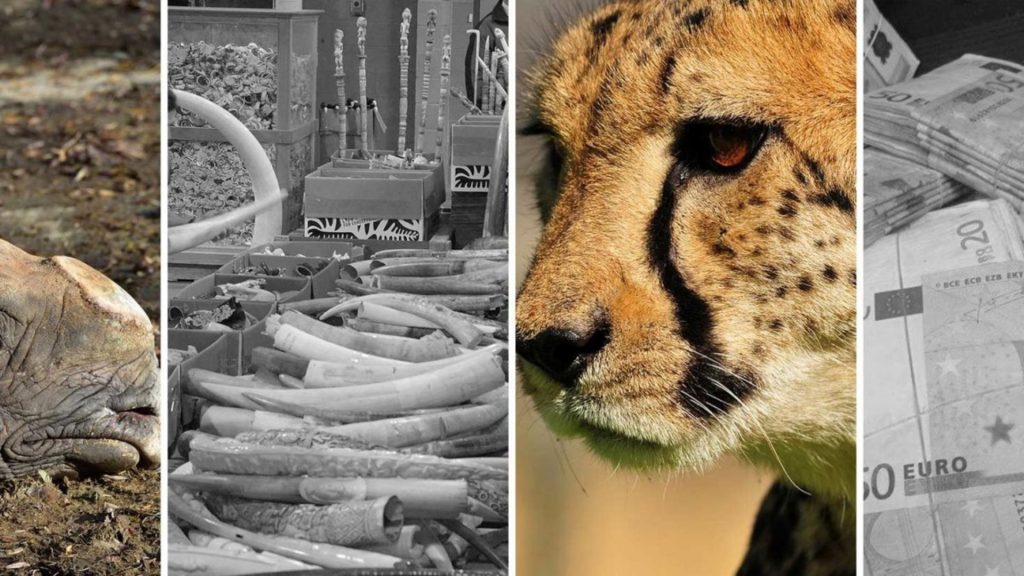

The general risk indicators suggesting illegal wildlife trade and money laundering. Wildlife and wildlife products are illegally traded every day and destined for a variety of different marketplaces. While each marketplace certainly has its own characteristics, there are some common red flags that might suggest illegal wildlife trading and/or money laundering activities related to the illegal wildlife trade.

General Risk Indicators Suggesting Illegal Wildlife Trade And Money Laundering

Since China assumed the presidency of the FATF from 1 July 2019 to 30 June 2020, the illegal wildlife trade has become a top priority. While only one meeting has been held thus far, FATF is currently working on analyzing supply chains, payment methods, and the illegal wildlife trade in general in order to develop a best practice approach to the illegal wildlife trade and money laundering.

The illegal wildlife trade and money laundering may rely on network effects to be effective and elusive, but removing one part of the network is a powerful way to damage the structures that keep the industry running.

Let us start by discussing some general red flags that could indicate illegal wildlife trade.

High-Risk Countries

The first red flag relates to the specific countries that might be involved in a particular trading activity or the financial transactions relating to a trade. Illegal wildlife trade is oftentimes tied to specific countries. A combination of a country-of-origin home to high-in-demand wildlife, the involvement of a transit country known for transshipments of wildlife, and destination country that either hosts a larger wildlife market should ring alarm bells. In addition, the involvement of citizens of particular destination country with large wildlife markets, such as China or Vietnam, could increase the risk of illegal wildlife trade being present.

High-Risk Trading Routes

A second red flag relates to an unusually number of changes within a trade activity itself. For example, if the consignee’s name, the route of shipment, or the port of delivery are being changed after the freight initially leaves the port, an illegal trading activity could be present. By these means, trade routes that involve regional corridors known for illegal wildlife trade should raise warning signs.

Misusing Legitimate Businesses

The third red flag relates to mixing legal and illegal means of activity. For example, businesses active in the legal wildlife trade might comingle legal with illegal products and may be treated as high-risk customers by default. If a legitimate business has ever been convicted for engaging in illegal wildlife activities, it might even be kept on an internal blacklist. Commercial screening systems or providers of historic company data including adverse media screening can support the process of identifying such companies. Similarly, shell companies or front companies might serve to hide activities relating to illegal wildlife trade.

Declared Goods

The fourth red flag relates to the declared goods of a particular shipment. If there is an export of any species maintained in the Appendix I of the CITES treaty, it might be indicative for illegal activities if, for example, commercial trading activity could be apparent.

Final Thoughts

Despite being the fourth largest type of organized crime in the world, just behind drug trafficking – the UN values illegal wildlife trade at over $23 billion, which creates an attraction for criminals to launder money through the illegal wildlife trade – the illegal wildlife trade is not always given the same level of focus as other serious organized crimes.

However, while statistics are useful in determining the size of the criminal industry, it ultimately boils down to the same problem as any other type of crime that encourages money laundering – catching perpetrators in the act.